The SmartPurse Barometer 2022

A three-year study on women's financial journeys and what needs to happen to close the engagement gaps

About

Since its inception, our voluntary financial health snapshot online survey has been capturing answers over a period of 3 years from April 2019–April 2022.

It has been completed by more than 2,500 individuals from over 40 countries.

This report summarises what we have learned from the anonymised data.

#1 The landscape

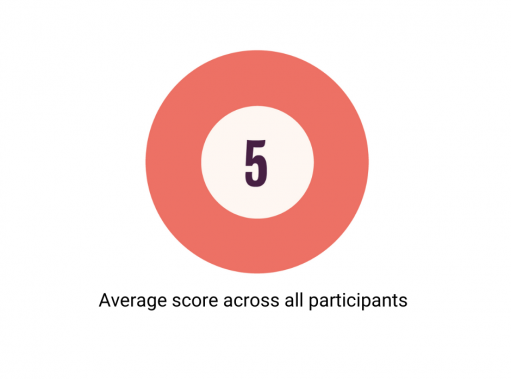

Midway average financial health score across the globe

Women self-rate their overall financial health with an average score of 5.0 out of 10 across all questions for the three-year period.

There are almost no differences on a country comparison, with both the UK and Switzerland showing the same average and rating slightly lower (5) than the rest of the world (5.3).

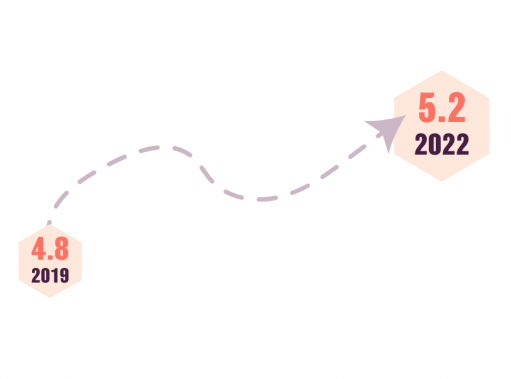

Confidence and engagement are improving

COVID and the increased attention on personal finance matters has increased the financial confidence of women across all categories and led to an increased motivation to start investing.

Female financial literacy is the modern solution to the growing gap in emerging and developed economies.

#2 Women are taking action

Safety net

More women have built a safety net and emergency plan (av. score increase by 0.55 = 12%).

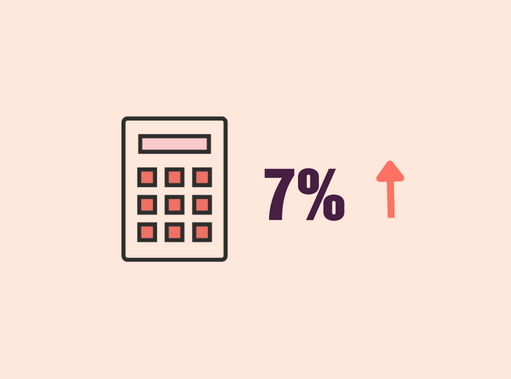

Making a difference

More women have a sharpened awareness of how to use money as a tool to make a difference (av. score increase by 0.33 = 7%).

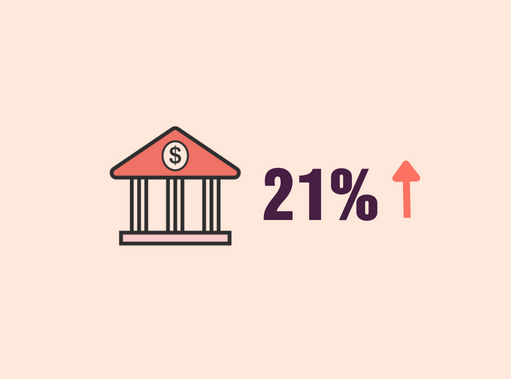

Working with specialists

More women know how to find a professional advisor (av. score increase by 0.78 = 21%).

84%

Rate themselves as good to very good at knowing how much they earn and spend.

77%

Feel confident and good about having money conversations with friends, partners, their children and employers.

#3 What's holding women back?

Planning for the future

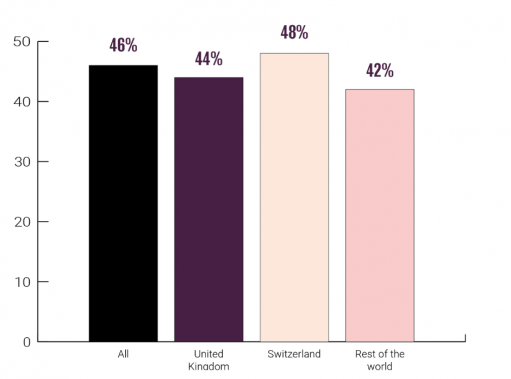

Nearly half the women surveyed seem to be struggling with financial planning: 46% rated themselves as below average in knowing their objectives for the next one, five and 10 years and how much money they might need to achieve them.

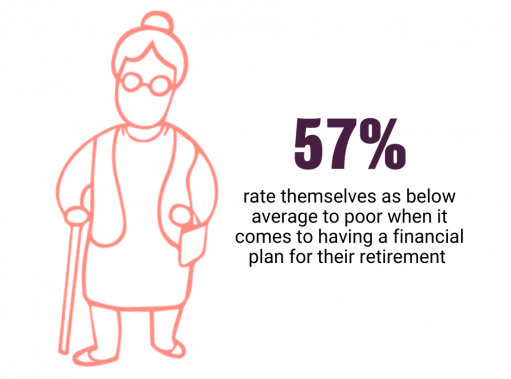

Building wealth for retirement

57% rate themselves as poor at having a financial plan for their retirement, with 33% seeming to have no retirement plan at all.

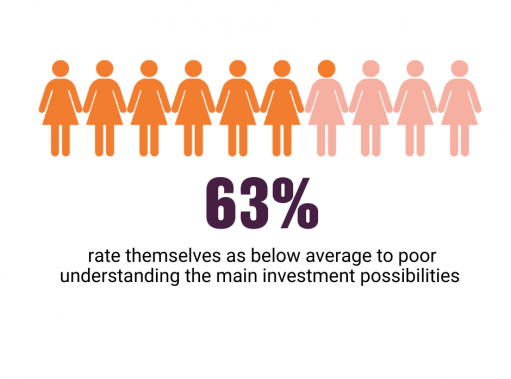

Leveraging all investment possibilities

63% rate their understanding of the main investment possibilities such as stocks, bonds, ETFs, robo-advisors as below average to poor.

The Wealthier report found that there is a marked difference between men and women in what they invest in. Men are 3 times more likely to invest in sophisticated financial products such as stocks and bonds, than women, whereas women save and invest in cash ISAs at the same levels as men.

#4 The time-risk-investment trap

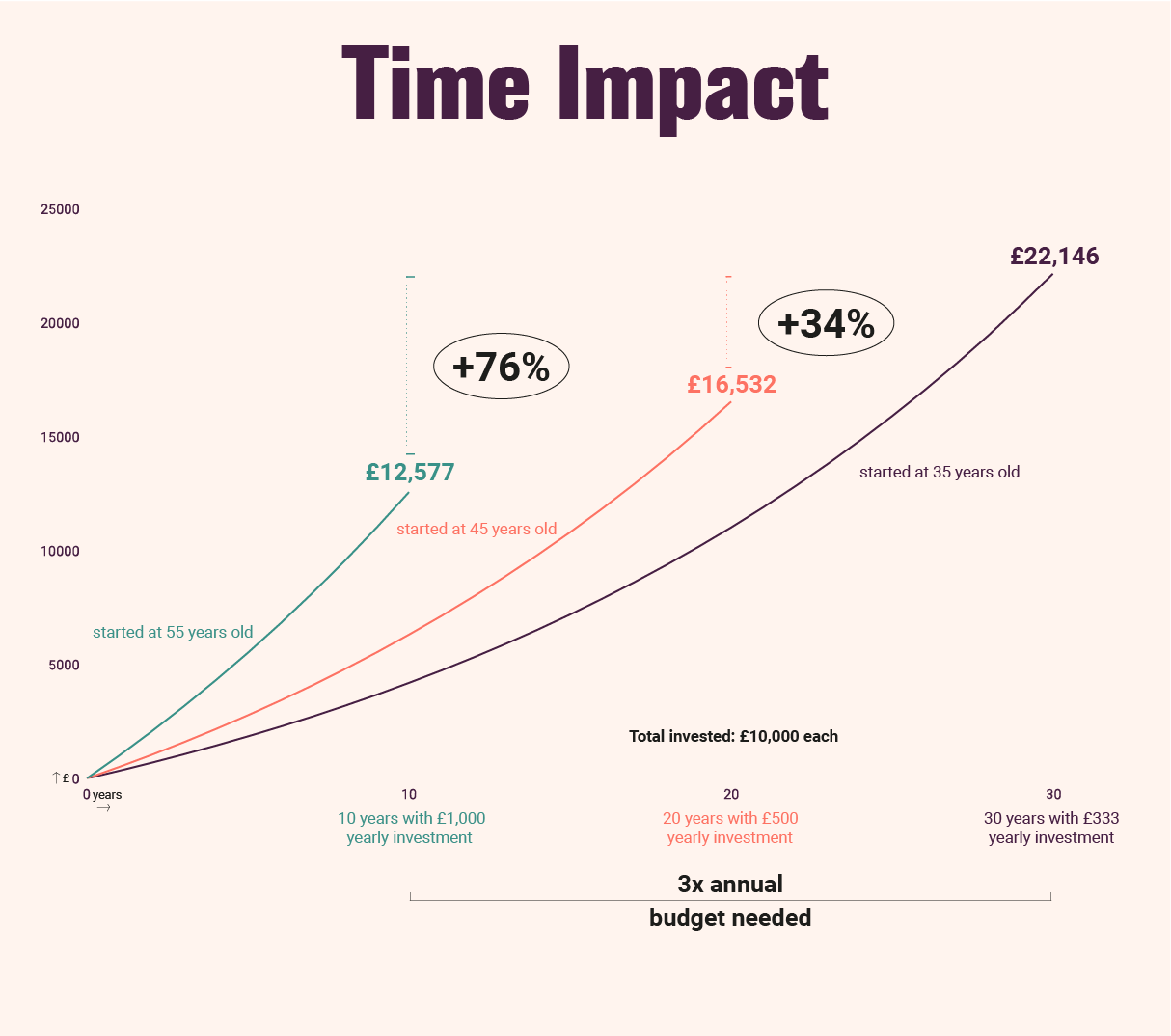

Our experiment

Three women of age 35, 45 and 55 start to invest.

Each invests a total of £10,000 with annual payments and a comparable strategy with an annual return of 5%.

The questions we asked

Does investing early really make a significant difference?

Can you mitigate your retirement gap with investing, even if you are already 55 today?

The younger woman can achieve a 76% better outcome with a third of annual investment needed compared to an older woman starting at age 55.

The 55-year-old woman can achieve improved outcomes, but needs to either increase her annual investment amount significantly (£1,760 p.a. vs £333 p.a.) or achieve a 3.3x higher annual return (16.8% vs. 5%) to get the same result as if she had started at the age of 35.

#5 Financial services providers should do more to connect with women

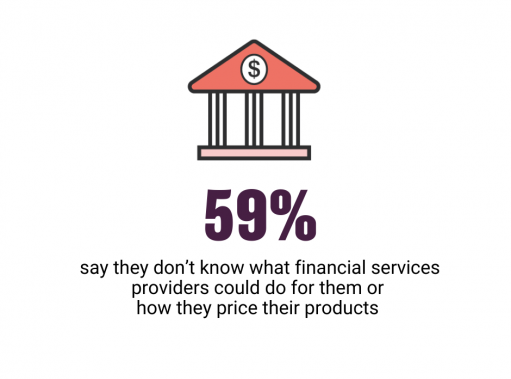

Specialisation makes choice difficult

In our survey almost 6 out of 10 women say that it is not very clear what the different financial service providers are offering. One of the most common questions we receive in seminars is what provider to use for what purpose.

Challenge to find a trusted advisor

While more women are seeking professional advice when it comes to their finances, finding the right person to connect to on a personal level remains a challenge, with 61% of women saying they would not know where or how to find a trusted advisor.

If gender neutral strategies worked, we would not see the huge gender gaps in women’s use of financial services. Companies need to adopt gender intelligent design to capture the world’s fastest growing economy, the female economy.

Conclusion

Women's financial confidence is increasing and they have good, disciplined financial hygiene and the desire to make a difference with their money.

What’s holding them back are very practical challenges:

#1

Building a financial plan that meets their life goals and longer life spans.

#2

Deciphering the investing language

#3

Understanding of how to make use of the investing tools and advisor expertise to their advantage

It is only now, this moment, that I truly believe we will begin to see the type of interventions, at scale, that will bring women more fully in to their financial power.